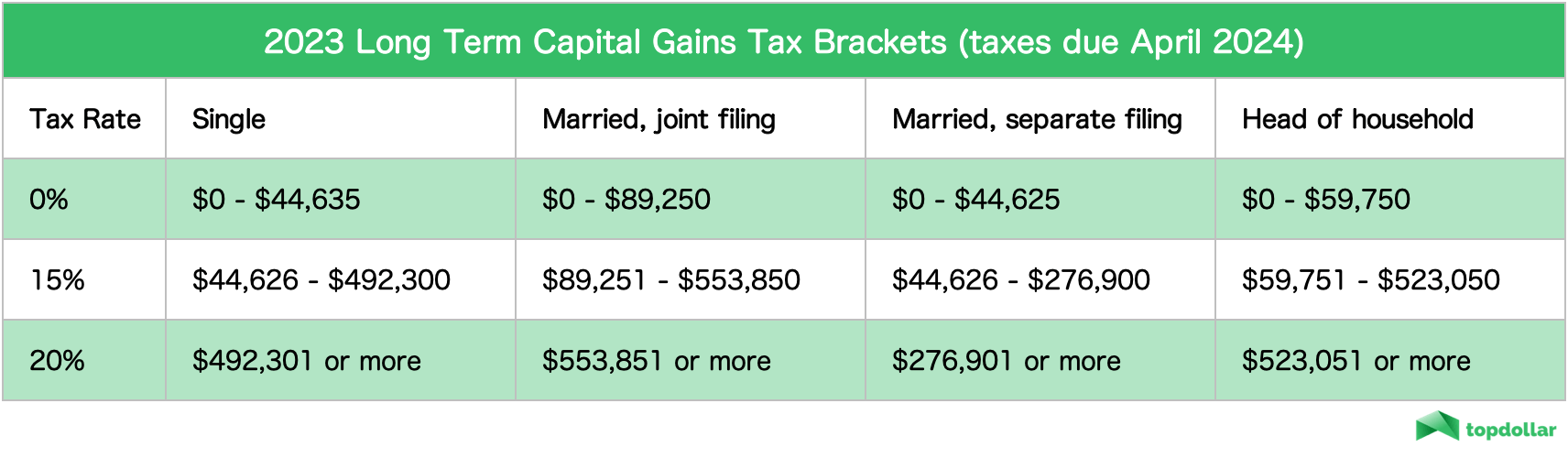

Capital Gains Tax Rate 2024. Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns. This guide provides a detailed overview of, what is a capital gains tax for 2024, including tax rates, calculation methods, and strategies to minimize or avoid taxes.

This guide provides a detailed overview of, what is a capital gains tax for 2024, including tax rates, calculation methods, and strategies to minimize or avoid taxes. 2024 capital gains tax brackets.

Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns.

Tax Rate For Capital Gains 2024 Hildy Latisha, Discover what is capital gains tax, including their types, how capital gains are calculated, and applicable tax rates. All capital gains are liable to be taxed with capital gains tax.

Nys Capital Gains Tax Rate 2024 Helli Krystal, All capital gains are liable to be taxed with capital gains tax. Capital gains tax rate 2024.

Why You Won't Regret Buying Treasury Bonds Yielding 5+ The Insight Post, Above that income bracket, the rate jumps to 20 percent. As of today, the inclusion rate — the taxable percentage — goes from 50 to 66 per cent on capital gains above $250,000 per year for individuals, and on all capital gains realized by.

Cryptocurrency Taxes A Complete Tax Guide For All Cryptocurrencies For, There are two main categories for capital gains: Capital gains from transfer of units of “ specified mutual fund schemes ” acquired on or after 1st april 2023 are treated as short term capital gains taxable at applicable slab rates as provided above irrespective of the period of holding of such mutual fund units.

The Advantages Of Proudly owning Shares Over Actual Property For Some, In 2024, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making $63,000 or less pay 0% on. Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns.

What Is The Capital Gains Tax Rate For 2022 2022 CGR, All capital gains are liable to be taxed with capital gains tax. There are two main categories for capital gains:

Capital Gains Tax Rate 2024 Home Sale Essa Ofella, Filing your income tax return (itr) can be straightforward if you follow the correct steps. Capital gains tax rate 2024.

Capital Gains Tax Rate 2024 House Sale 2024 Cam Maribel, Married couples filing jointly can get the 0% rate if. As of today, the inclusion rate — the taxable percentage — goes from 50 to 66 per cent on capital gains above $250,000 per year for individuals, and on all capital gains realized by.

Capital Gains Tax 2024 Real Estate Calculator Brear Cissiee, Capital gains tax rate 2024. For the 2024 tax year, you won’t pay any capital gains tax if your total taxable income is $47,025 or less.

The taxation of capital gains and the proposed inclusion rate increase, Understanding the nuances of capital gains tax can help you minimize your tax liability and maximize your returns. The capital gains tax rate for a capital gain depends on the type of asset, your taxable income, and how long you held the.

Several wealth managers said “lots of clients” had been in contact with questions about a possible cgt increase.

In 2024, single filers making less than $47,026 in taxable income, joint filers making less than $94,051, and heads of households making $63,000 or less pay 0% on.