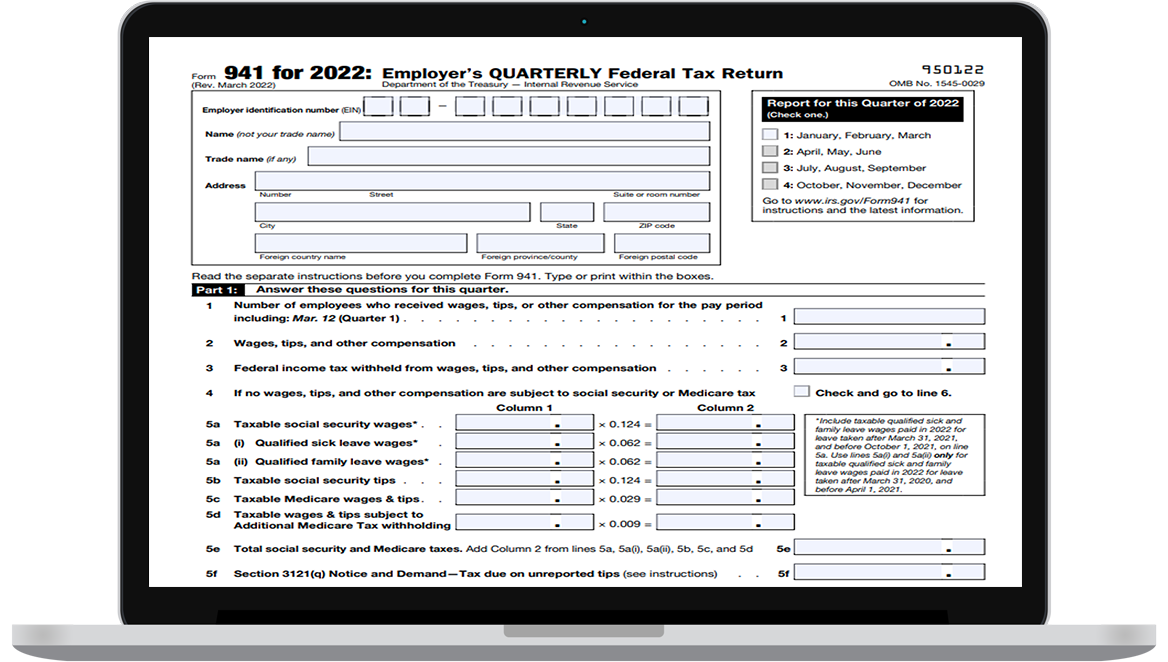

Form 941 Year 2025. The social security wage base limit for 2025. Schedule b, report of tax liability for semiweekly schedule depositors;

941 irs Fill out & sign online DocHub, The social security wage base limit for earnings in 2025 is $168,600, up from the 2023 limit of $160,200. Where you file form 941 depends on your state and whether you make a deposit with your filing.

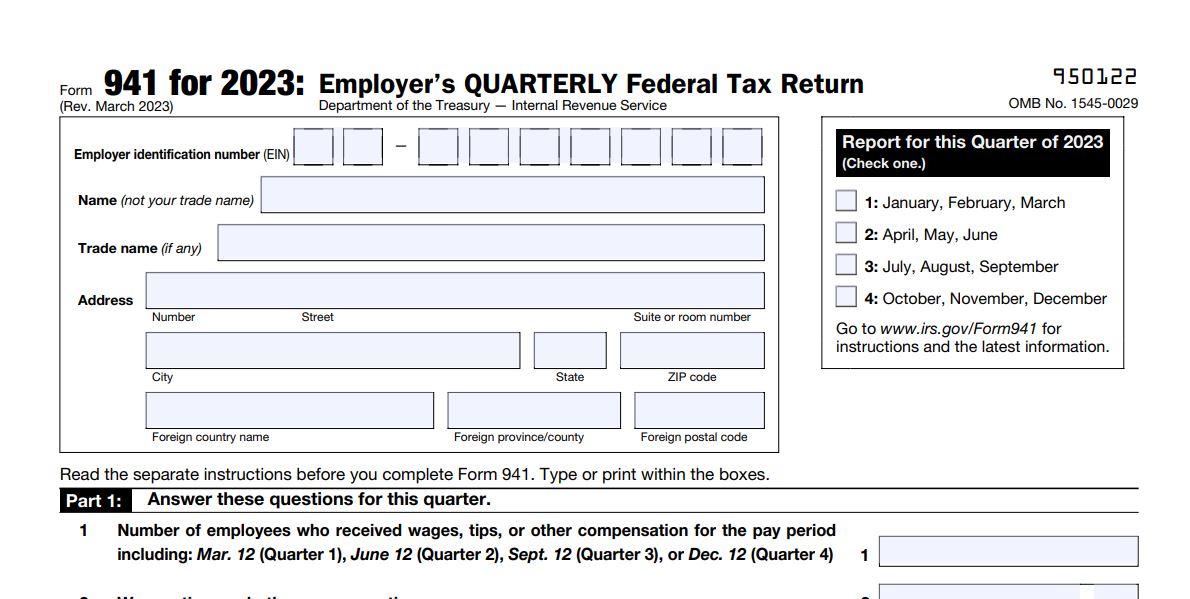

How to Complete Form 941 in 5 Simple Steps, For the 2025 tax year, the form 941 filing deadlines remain critical for employers to adhere to, ensuring timely compliance with tax reporting obligations. The irs released the 2025 form 941, employer’s quarterly federal tax return;

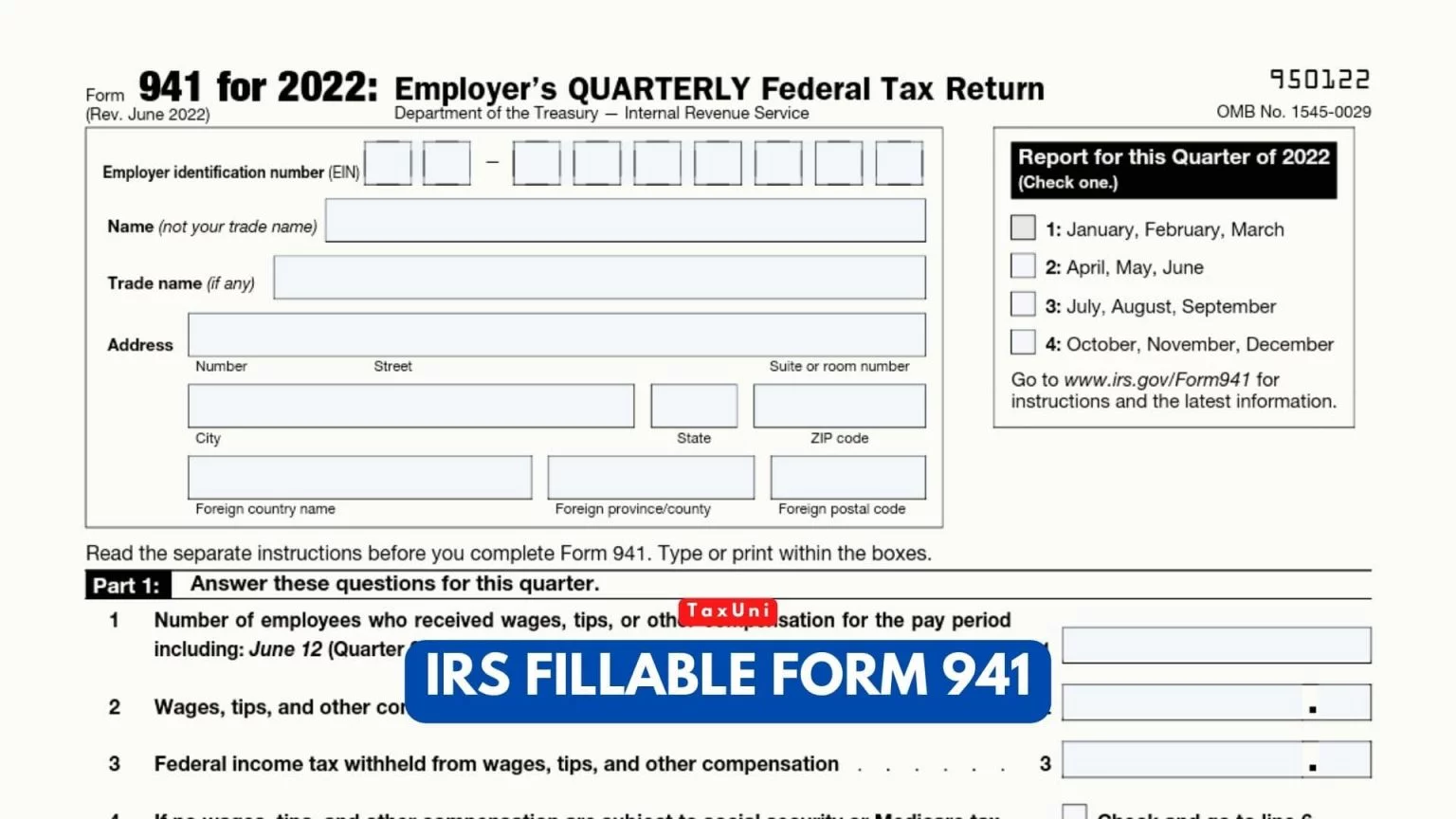

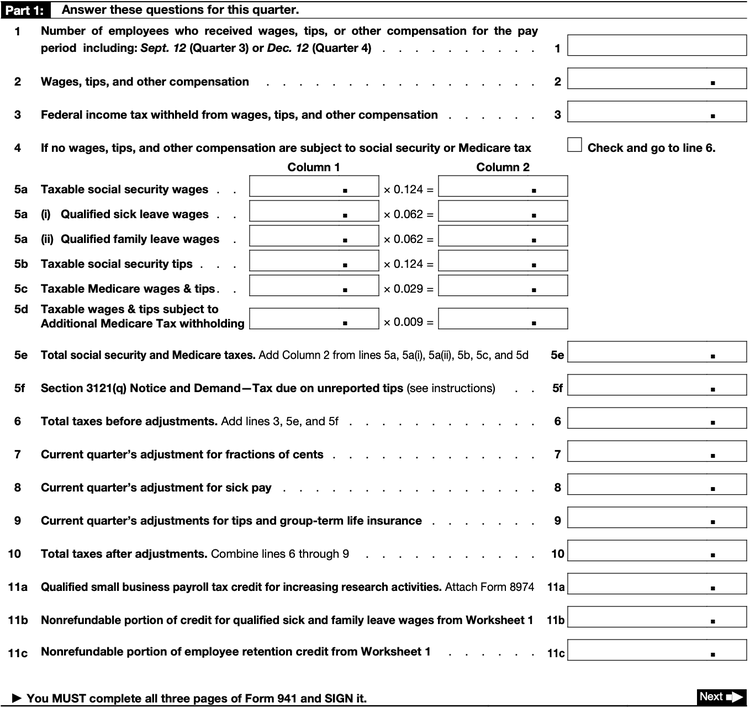

IRS Fillable Form 941 2023, According to the new updates, form 941 has few major changes. For tax years beginning before january 1, 2023, a qualified small business may elect to claim up to.

941 irs Fill out & sign online DocHub, For tax years beginning before january 1, 2023, a qualified small business may elect to claim up to. Employers are advised to start using the march 2025 revision of form 941 beginning with the first quarter of 2025.

Form 941 pr Fill out & sign online DocHub, 2025 irs updates for form 940 and form 941 (ty 2023) december 8, 2023 by michaela porterfield. The irs has released changes to form 941 for the 2025 tax year.

How to Prepare and File IRS Forms 940 and 941, Correct errors, claim refunds, and seize ertc benefits retroactively. The irs encourages businesses to electronically file form 941.

Form 941 Excel Template, There are a few changes to form 941 that employers should be aware of before filing form 941. A new irs draft of form 941 means new updates to your business's quarterly payroll filing.

What is the IRS Form 941?, The irs recently released a draft of form 941 for the 2025 tax year. The irs released the 2025 form 941, employer’s quarterly federal tax return;

How do I fill out form 941 if I have no employees 2023 Q1 Nina's Soap, Washington — the internal revenue service today urged taxpayers to take important actions now to help them file their 2023 federal income tax return. For the 2025 tax year, the form 941 filing deadlines remain critical for employers to adhere to, ensuring timely compliance with tax reporting obligations.

EFile Form 941 for 2022 File form 941 electronically, Based on this draft, the following changes have been made to the form: Why is federal taxes (941/943/944) showing in qb that this quarterly tax is for:

Employers are advised to start using the march 2025 revision of form 941 beginning with the first quarter of 2025.

Fireballs In The Sky 2025. These celestial events provide a tangible. Est (0030 gmt on dec. Spooky season of the…

Mothers Day Brunch Nashville 2025. The mother's day brunch buffet will run saturday, 10 a.m. Gaylord opryland tickets ticket reservation…

Lobsterfest Maine 2025. This annual seafood festival takes place during the first weekend of august, from wednesday through sunday. From…