Most Expensive States To Retire In 2025. Which state is the cheapest to live in? Here's how to strategize withdrawals, optimize tax advantages and beat inflation ahead of a 2025 retirement.

Massachusetts, california, and new york all had minimums of $1.2. Here are the cheapest (and most expensive states) for retirement in 2025.

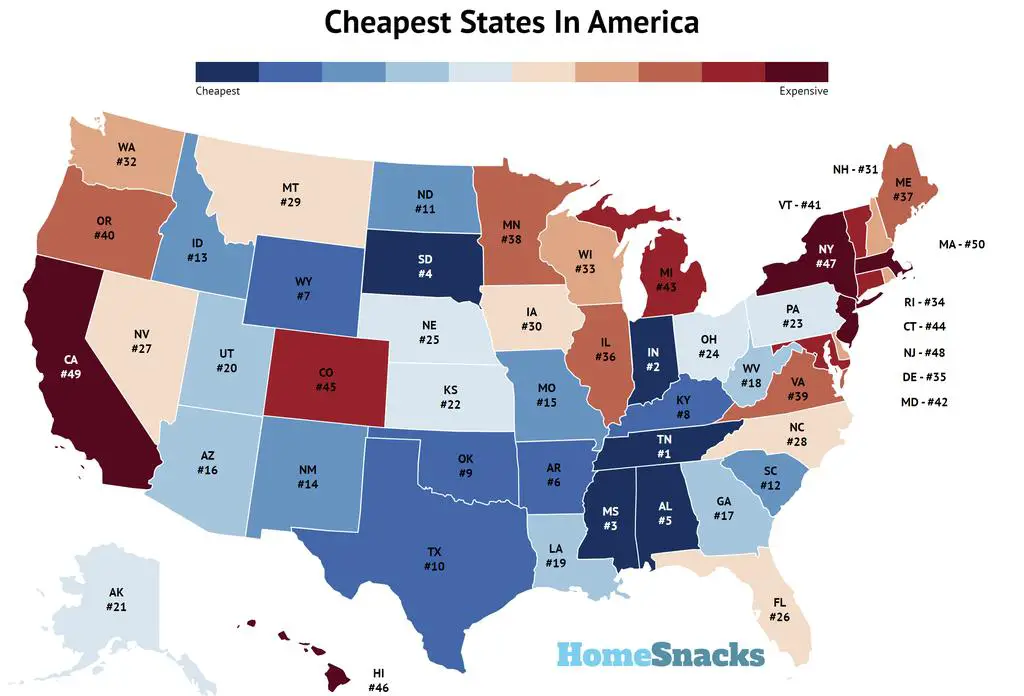

For retirement, iowa stands out thanks to its combination of low median rent, high supplemental security incomepayments (ssi), and favorable.

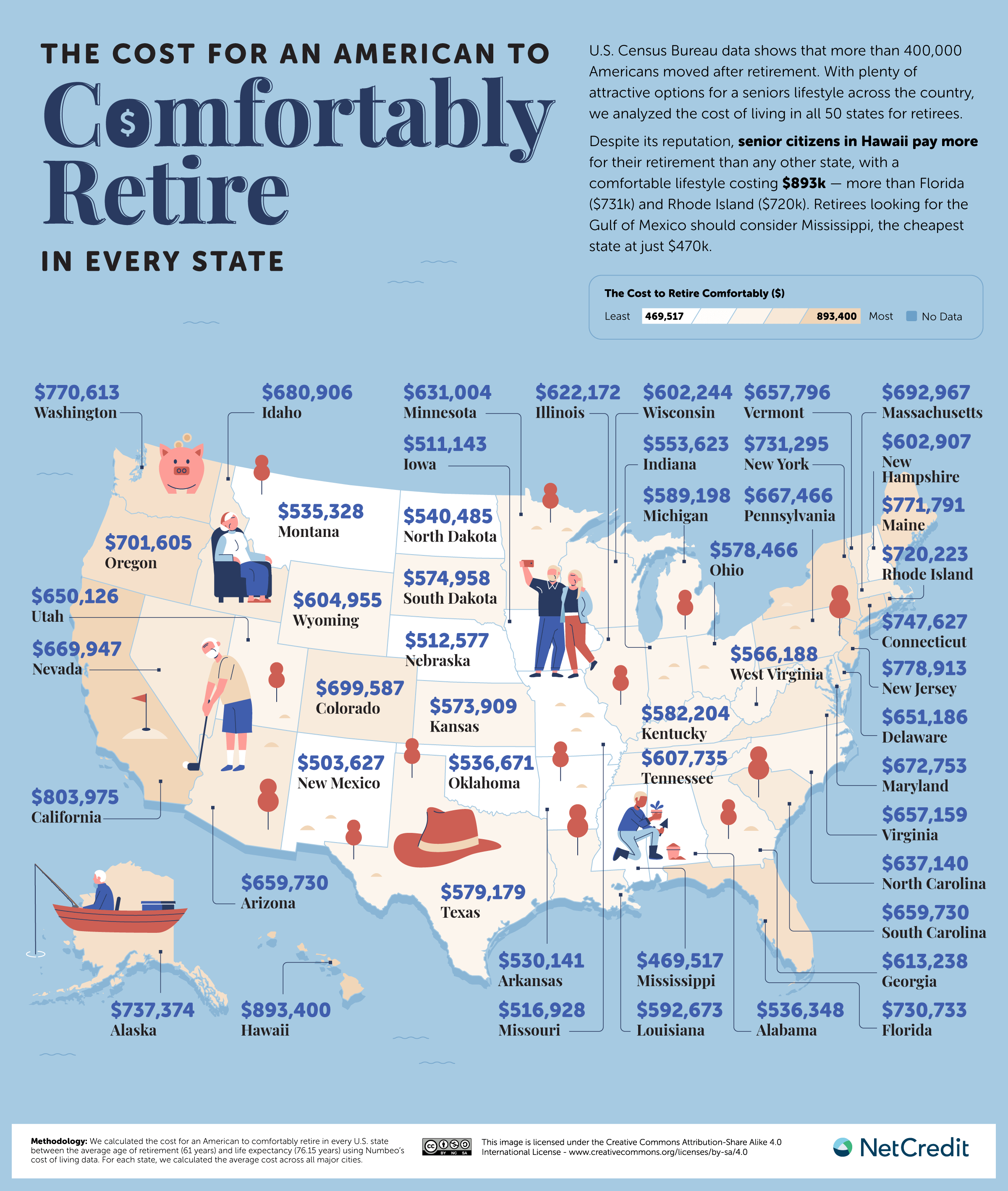

The Cost for an American to Comfortably Retire in Every State and, Cnbc’s annual america’s top states for business study considers cost of living as a factor in competitiveness, scoring states based on an index of prices for basic items. Which state is the cheapest to live in?

Best Days To Retire Fers 2025 2025 Elise Corabella, Which state is the cheapest to live in? What follows are quick snapshots of the five least expensive states for a comfortable retirement, based on the 24/7 wall street rankings, followed by the five.

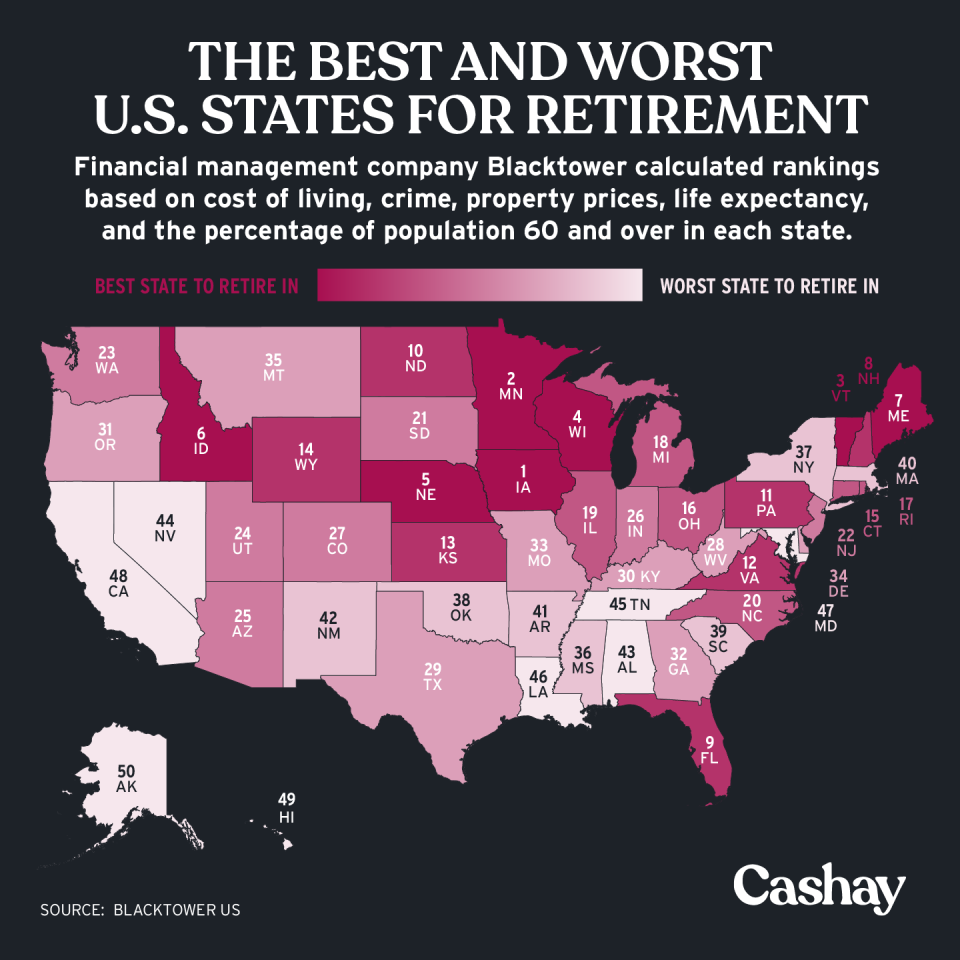

The best and worst U.S. states for retirement, If you want to retire in 2025, here's what you need to prep now. Although a state’s housing costs can be an important consideration when deciding where to spend.

Map Here are the best and worst U.S. states for retirement Cashay, Here's how to strategize withdrawals, optimize tax advantages and beat inflation ahead of a 2025 retirement. Hawaii claimed the top spot as the most expensive state in terms of cost of living, with an average annual expenditure of $55,491.

Map shows how much you need to comfortably retire in each state Daily, Us news ranks the states with the best economic affordability, based on the cost of living and housing affordability. New york has been identified as the most expensive state for retirees in america, according to the latest data from ceoworld magazine.

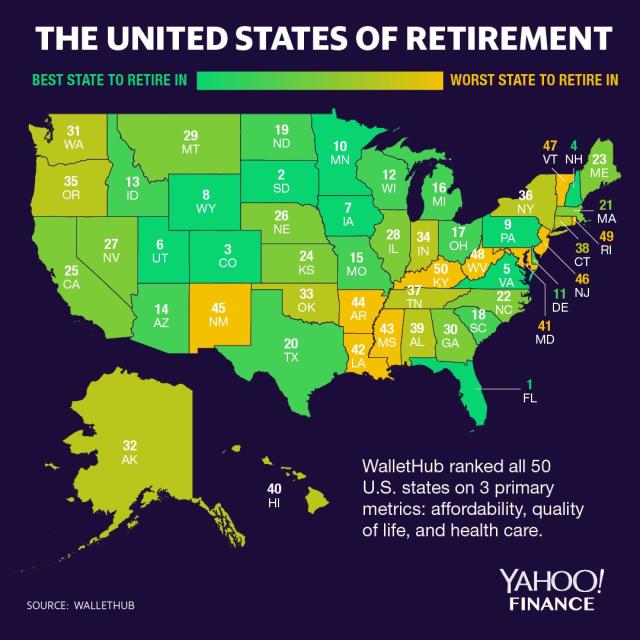

The Best and worst U.S. states to retire Vivid Maps Retirement, The top five best states to retire to in 2025 are new hampshire (1), utah (2), minnesota (3), connecticut (4), and colorado (5). Housing costs drive the cost of living expenses since this is.

Vermont among most expensive states for renters Vermont, While the best state to retire will ultimately depend on a retiree’s unique circumstances and interests, some states may not be the most ideal based on factors. The five states that charge the highest combined (state and local) rates are tennessee (9.548%), louisiana (9.547%), arkansas (9.44%), washington (9.40%), and.

WalletHub New York tops the list of most expensive states to retire in, Here are the cheapest (and most expensive states) for retirement in 2025. For retirement, iowa stands out thanks to its combination of low median rent, high supplemental security incomepayments (ssi), and favorable.

The 10 most expensive US states to retire in Daily Mail Online, The top five best states to retire to in 2025 are new hampshire (1), utah (2), minnesota (3), connecticut (4), and colorado (5). The five states that charge the highest combined (state and local) rates are tennessee (9.548%), louisiana (9.547%), arkansas (9.44%), washington (9.40%), and.

Cheapest States To Retire In 2025 Kitty Michele, Topping the list as the cheapest state in the u.s. Cheapest states to retire in 2025.

In its study, gobankingrates analyzed all 50 states to uncover where a retiree will need to have saved $1 million for 25 years and for 30 years.